Unraveling Forex Swaps: What Are Swaps in the Forex Market

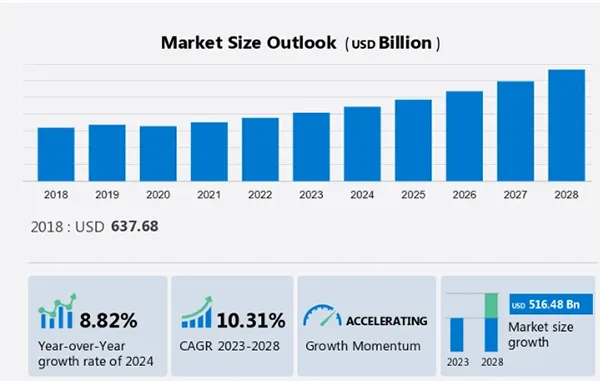

The foreign exchange industry is the biggest market in the world, with trillions traded globally. It is constantly growing, with approximately 6.6 trillion USD traded daily in 2019.

Despite the mild stagnation due to the pandemic, it has shown rapid economic growth, reaching US$ 753.2 Billion in 2022.

There are over 180 currencies worldwide; so what happens when an exchange is needed between two currencies? That’s where forex market swaps come into play.

The FX or currency switch assists companies in borrowing at a rate that is less expensive compared to what’s available in the local economic institutions.

This article provides a clear overview of understanding forex swaps, their purpose in detail, and the different types of financial exchanges.

What are Forex Market Swaps?

A Forex market or FX swap is an agreement between two parties to exchange funds. They agree to exchange the principal amount and interest payments on loans in different currencies.

It’s a bit like borrowing money in one currency and lending it in another. This helps investors deal with different interest rates and protects them from any sudden fluctuations in exchange rates.

It’s a way to manage risks and make the most of the opportunities in the world of foreign exchange. Transactions across nations become much more seamless for businesses, resulting in efficiency in managing investments.

It’s significant to mention that the actual currencies, or the principal of the loans, are seldom exchanged in such dealings.

DO YOU KNOW?

J.P. Morgan is the largest foreign exchange company and a leader in investment and commercial banking, financial transactions, and asset management, serving millions of customers worldwide.

What is the Purpose of Forex Market Swaps?

Swaps are utilized by large companies or banks that need to invest money in foreign currency. They do so by purchasing the funds and, in return, selling their funds simultaneously.

Forex market swaps are intended to minimize the risks of lending and avoid the often-high rates of traditional fund exchange methods.

Currency value is unpredictable and can fluctuate daily, which can make shareholders connected to the company precarious. Exchanging means that businesses can invest in the desired currency at a fixed rate, preventing any extreme losses due to market volatility.

By doing this, they don’t have to worry about the risk of the currency’s value deflating. Similarly, if its value inflates, the fixed rate remains the same. By being aware of market volatility and investigating prior transactions of the counterparty, businesses can avoid liquidity risks.

As seen in the graph below, the latest survey report shows that the foreign exchange market has been growing steadily since 2018. It is predicted to keep increasing without any downturn till 2028.

Types of Swaps

There are two key types of swaps in the foreign exchange market. They are referred to as fixed-for-fixed swaps and fixed-for-floating swaps. The type of switch will be agreed upon by the two parties.

Fixed-For-Fixed

In fixed-for-fixed forex market swaps, two parties will exchange currencies on the principal amount negotiated.

It is a type of financial agreement between both parties where the exchange has fixed interest rate payments over a specific period.

Both parties must agree to the trade with no additional conditions. This is useful in situations where interest rates on a country’s funds may be cheaper than other countries.

In fixed-for-fixed trades, both parties have the freedom to utilize the fund’s stability and customize it to meet specific requirements. This makes it easier to align each party’s cash flow needs and financial objectives.

Fixed-For-Floating

Fixed-for-floating swaps are still agreed between two counterparties, but they work a little differently.

It involves one party trading a fixed-rate loan, also known as a cash flow interest, with a floating rate from another party. By using this method, companies can benefit from other countries’ interest rates.

This is used in instances where assets may be more prone to fluctuating interest rates. It helps each company to manage its financial transactions in a better way without incurring any additional exchange costs.

Conclusion

Foreign exchange market switches are an effective and beneficial way for businesses to exchange funds with one another whilst minimizing the risk and maintaining a fixed currency rate. Trades allow parties to manage fund risks and enable international trade.

Any type of crisis is difficult to counter once it has already impacted international markets. During such scenarios, Forex swaps become a reliable negotiating deal to rise above the wavering economic waves.

Many businesses employ diversifying their funding exposure as a risk-mitigation strategy, but a confirmed immunity is playing safe with no profitable trading.

You can be an avid trader who regularly exchanges funds, a financial enthusiast, or a business looking to exchange currency, forex swaps are worth exploring.